Ohio's Engineered Materials:

An Endless Chain of Opportunity

Ohio's geographic advantages, its knowledge base, its labor talent and its supportive environment spell advantage for makers of engineered materials. Like the ever-widening molecular combinations that yield new polymer materials, Ohio has an infinite chain of opportunities for profit.

by Linda Liston

The year is 1870. Dr. B.F. Goodrich has decided to move his little rubber company to Akron in Northeast Ohio. In a few years he is joined by Goodyear and Firestone.Those serendipitous site selection decisions launched Ohio on a roller coaster ride that lasted a century.

On the ride up the roller coaster, Ohio amassed an enormous pool of knowledge and labor talent, as well as a reputation, firmly seated by the 1920s, as the world's rubber capital. At the pinnacle of the ride, 70,000 people (an astonishing number for the times), worked in Ohio's rubber industry.

| But what goes up must come down. Ohio's rubber industry, punctured by outmoded plants and global competition, was flat by the mid-70s. Unemployment soared, and the popular moniker of the times --"Rust Belt" -- seemed to fit Ohio like a pair of aerobic pants.

But while the natural rubber industry was in its heyday, work was also being done on synthetic rubber. A crash program to serve the defense effort in WWII produced not only a substitute for natural rubber but also some other interesting polymer possibilities. The fledging science of combining molecules in new ways to create new properties began to flower. |

|

A word about terms used in this report: Polymers cover a wide range of synthetically created products, including rubber and plastics. "Polymers" is the preferred term in the academic setting, and some manufacturers like to use it, too, to sidestep the uninformed opinion of plastics. "Plastics still means 'cheap' and throw-away' to many people," says one industry executive.

Engineered Materials cover plastic and rubber products, resins, glass and such composites as fiberglass and value-added steel and metal products. These are key targets for the state. While we describe many engineered products in this report, the focus is on plastics because of the breadth of opportunity in the field.

|

|

|

In the 1950s there were perhaps four polymers -- today there are over 21,000 combinations of molecules that have imbued plastics with heat, shatter, chemical and corrosion resistance, as well as higher strength to weight ratios. Polymers are the largest and fastest growing class of materials in the world, replacing wood, paper, glass and metal in an increasing number of applications. The low cost and versatility of plastics boosted polymers ahead of steel in the 1970s.

Just one example of that versatility: Remember Teflon,® the slippery substance DuPont developed for the Space Age more than 40 years ago? Teflon® later had every housewife in America singing hallelujah when DuPont brought the polymer to the marketplace as a coating for cookware. Today, Teflon® and its cousins take many forms and have many, many applications, such as sealing the fluids in your car.

The point is that new applications are discovered every day, and polymers are a leading growth industry around the globe.

A Growth Industry

U.S. production of plastics has grown at an annual average of 4.8 percent since the late 1960s, twice the growth rate of the U.S. domestic product. The U.S. consumes more plastic than any other nation -- in fact, as much as all western European countries put together, more than all of Asia and nearly six times as much as Latin America.

| This trend bodes well for Ohio's plastic products makers, many of whom are surging into export markets.

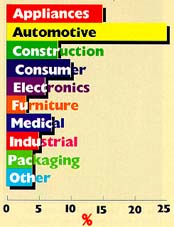

Plastic is used in an extraordinarily broad range of products in the U.S., but more than half the demand comes from the packaging industry (31 percent) and the building and construction industry (20 percent). The transportation, electrical/electronic and furniture/furnishings industries are also key end users. Plastics for the health care industry are showing interesting possibilities. As the versatility of plastics prompts a wider range of uses, the less the industry will be susceptible to cyclical demand. |

Ohio Plastics Manufacturing

by End Market, 1995 |

|

| Source: Plastics Technology Census, D&S Resources |

|

And that augurs well for Ohio, because Ohio, situated in the most active part of the playing field, is the knowledge and production leader in the polymer industry.

Review the rankings.

Ohio First

When it comes to superlatives, Ohio has many of the industry's gold medals:

#1 in plastics industry employment, edging out the former leader, California,

#1 in plastics industry employment, edging out the former leader, California,

in 1996. The plastics industry supports 100,000 jobs in Ohio.

#1 in plastic products shipments in the U.S., a $15 billion a year -plus industry in Ohio.

#1 in plastic products shipments in the U.S., a $15 billion a year -plus industry in Ohio.

#1 in plastics employment concentration (more than double the U.S. figure), with 14.8 employees per thousand non-agricultural employees. About 10 percent of the nation's plastics industry work force staffs Ohio plants.

#1 in plastics employment concentration (more than double the U.S. figure), with 14.8 employees per thousand non-agricultural employees. About 10 percent of the nation's plastics industry work force staffs Ohio plants.

#1 in value of plastics processing machinery. With $539 million worth of machines shipped in 1991, Ohio makes more plastics machinery than the combined total of the next three highest states -- Michigan, Pennsylvania and Massachusetts.

#1 in value of plastics processing machinery. With $539 million worth of machines shipped in 1991, Ohio makes more plastics machinery than the combined total of the next three highest states -- Michigan, Pennsylvania and Massachusetts.

#1 in plastics machinery employment, with 4,000 workers, nearly a third of all U.S. employees in the field. The next highest state, Michigan, employs just 1,500.

#1 in plastics machinery employment, with 4,000 workers, nearly a third of all U.S. employees in the field. The next highest state, Michigan, employs just 1,500.

#1 in new plants and expansions to serve the plastics industry for the last two years. According to the Ohio Economic Development Council, industry invested $829 million in 146 new and expanded Ohio plastics plants, adding 5,873 jobs.

#1 in new plants and expansions to serve the plastics industry for the last two years. According to the Ohio Economic Development Council, industry invested $829 million in 146 new and expanded Ohio plastics plants, adding 5,873 jobs.

Ohio gets the silver medal for production of plastic molds, with 3,500 workers at 177 mold shops turning out $277 million worth of plastic molds in 1991. Michigan is the first ranking mold-making state.

If this reads like a dramatically different picture of Ohio than its "rust belt" image of old, you read right.

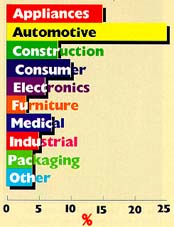

Ohio Plastics Share of Key

U.S. End Markets, 1994 |

|

| Source: Plastics Technology Census, D&S Resources |

|

Says Gov. George Voinovich: "The plastics industry has played a major role in Ohio's resurgence as an economic leader."

Ironically, it was engineered materials that contributed to the former image, with steel and rubber succumbing to global competition. But it is engineered materials like polymers that are pulling the state back to stardom. The former rubber industry has evolved into broadly based polymers, and the steel plants are refocusing themselves on niche products popular in the marketplace. Major investments like the Northstar/BHP minimill in Northwest Ohio and the USS/Kobe steel coating plant in Leipsic show the resurgence of Ohio's steel industry. For the last several years Ohio has seen some $400 to $500 million in iron and steel industry capital investment -- 56 projects from 1992 to 1994 represented investments totaling $1.4 billion. The largest investors were Armco and USS/Kobe . |

Ohio leads the nation with almost $5 billion of value added production of iron and steel goods, accounting for 19 percent of the U.S. total and one in six jobs in the industry. The output drives Ohio's auto and machinery industry, providing jobs for over 187,000 people in 4,200 plants.

The iron and steel industry is the ignition system that starts a massive metal-working complex. Some 435,000 Ohioans make machinery for companies like Cincinnati Milacron, Van Dorn Demag and Bliss-Salem; castings and stampings for Ohio's two dozen auto and truck manufacturing plants; ball bearings for Timken and many more goods, from basic nuts and bolts to sophisticated boilers for power plants.

| Leading players include LTV Corp. and Worthington Industries -- both Fortune 500 companies headquartered in Ohio. Republic Engineered Steels, AK Steel, USS/Kobe Steel, WCI Steel, Copperweld and Armco have major operations in the state. General Motors and Ford are the largest iron and steel foundry employers in Ohio.

Nor is the rubber industry among the forever departed. Goodyear still has its world headquarters and substantial tire-making capacity in Akron, and the tire industry continues to attract new suppliers. One is Mitsubishi Heavy Industries, which recently opened a plant to make tire presses in Columbiana County, south of Akron on the Ohio River. The company cited an eager work force, reasonably priced labor, competitive transportation costs and a good supply of engineering talent as reasons for its site decision. |

|

| Akromold is an old-line mold-maker that today serves the appliance, aerospace, auto, food service and consumer markets. To set it apart from competitors, the company continually invests in new technology. In the last 18 months Akromold has brought on $3 million in new equipment. |

|

"Our location in Columbiana County means we can work closely with tire makers in the region," says General Manager George Nakahara. The company brings fresh technology to its tire presses. "Big tire makers like Goodyear are looking to save seconds per tire-making cycle," says Nakahara. "The faster you can load a tire into and out of the press, the more you can control the cost of the tire."

Regional Resurgence

The regions of the state with the bleakest economic outlook in the 1970s are now Ohio's star performers. Cleveland, Akron and Youngstown today rank among the top 20 metro areas in the nation for new plants to produce plastic goods. Together with Columbus and Cincinnati, the cities occupy five of the top 20 spots among metro areas for new plastics facilities. According to Site Selection's New Plant database, no other state has as many metro areas in the top 20 for new plants to produce plastic products.

Why Ohio?

The rubber industry originally concentrated in Ohio for two reasons: the state was close to raw materials, such as coal and natural gas, and it was close to customers. The Ohio River, providing cheap transport of coal from the mines of Appalachia and resins from the refineries of Texas and Louisiana, played a major role in attracting the chemical plants, steel mills and power plants that now line both sides of the Ohio.

Today, two of Ohio's two biggest industries -- auto and agribusiness -- are large consumers of plastics. Thus there is a substantial local market driving the sector.

In agriculture, plastics become drainage tiles, hay and silage covers in the field, row covers and containers for the horticultural industry and packaging for finished products.

In the auto industry, plastics have replaced about 2,000 pounds of heavy metal in the typical car. This spelled opportunity for plastics makers. For example, when Honda located its four plants in central Ohio it drew 360 other plants to serve it -- many are makers of plastic and molded rubber parts. As research has produced plastic materials that rival the durability of metal, the consumer has been happy to accept the fuel economies that come with a lighter car.

| Nearly 15 percent of the cars and light trucks produced in the nation are assembled in Ohio; 57.8 percent are assembled in what has become the automakers' "just-in-time region," including Michigan, Ohio, Kentucky, Indiana and Illinois. Ohio's central location between Detroit and northern Kentucky places the state squarely in the middle of a large concentration of motor vehicle manufacturing. Other vehicle plants in Ontario and Quebec are also in just-in-time range. |

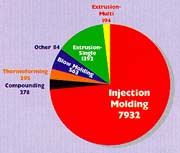

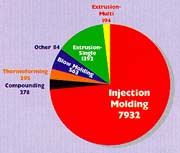

1,123 Ohio Plastic

Processing Sites |

|

| Source: Complied from Plastics Technology Census Available Through D&S Resources, Inc./Plaspe. |

|

Another reason for Ohio's top-ranking position in plastics is that the industry is not as "footloose" as, say, the electronics industry. Companies tend to expand in the same states that already have the highest plastics industry employment. Clearly, plastics is not among the industries that are leaving industrial states to migrate to high-growth states in the South and West.

To corroborate that point, look at statistics gleaned from Site Selection's New Plant database: the east north central region, led by Ohio, outranks all other regions in new and expanded plastics plants. It claimed 421 of the 1,544 new and expanded plastics facilities from 1989 to present. Moreover, the number of facilities is accelerating. The region saw 33 facilities in 1989, and 126 in 1995. No other region has seen that level of growth.

| Within Ohio, the plastics industry clusters in two main areas -- the Northeast around Cleveland, Akron and Youngstown, and the Southwest, from Dayton northward. Twelve counties house the majority of the plastics operations in the state -- Summit, Cuyahoga, Stark, Lake, Geauga, Lorain, Medina and Portage in Northeast Ohio; Franklin (Columbus) in Central Ohio; Hamilton (Cincinnati) in Southwest Ohio; Montgomery (Dayton) in Western Ohio; and Lucas in Northwest Ohio. |

Plastics Parts Exports from Ohio

(SIC 30) |

|

| Source: Mass. Inst. for Social and Econ. Research/ODOD |

|

However, almost every one of Ohio's 88 counties has a presence in the plastics industry. And as companies search outside the metro areas for more abundant labor and lower operating costs, the industry is sure to even itself out across the state.

Ohio's Strengths

The rubber industry found a plentiful supply of labor, abundant water and excellent rail and water connections when it first set up shop in Ohio in the 19th century.

Now, a century and a quarter later, those advantages are still apparent. But today they have evolved into sophisticated logistics systems and a broad base of talent built over the decades, amid the nation's greatest concentration of industrial customers.

Ohio's strengths for the plastics industry include a superior distribution infrastructure that covers all modes of transport, proximity to a large consumer and industrial market, a massive amount of plastics talent in the work force, well-developed research, training and networking resources and the broad availability of suppliers of every kind and description.

More than half of the plastics produced in the U.S. are consumed within a 600-mile radius of Ohio. That same circle encloses 61 percent of the nation's population and 63 percent of the nation's manufacturing capacity. Over half of Canada's consumer and industrial markets are in the same range. Ohio is in the distribution "envelope," where shippers can reach the greatest number of plastics consumers at the lowest cost.

|

| The EPIC Mini Pilot Polymerization Plant is one of many research resources that support growth of Ohio's polymer industry.Source: Complied from Plastics Technology Census Available Through D&S Resources, Inc./Plaspe. |

|

According to Lockwood Greene's Consulting Group, the plastic industry's top location factor is "quality transportation infrastructure." Ohio's integrated network of transportation infrastructure extends the just-in-time range for plastics producers. Ohio has five major interstate highways, service by three Class I railroads and nearly three dozen shortlines. Two-thirds (or 700 miles) of its border serve as shipping lanes -- the Ohio River for low-cost barge transport and Lake Erie for international commerce.

Several air carriers, including Emery, Airborne, KLM and Burlington Air Express, have selected Ohio for their shipping hubs, and three all-cargo airports at Rickenbacker (south of Columbus), Youngstown (in Northeast Ohio) and Wilmington (in Southwest Ohio) give Ohio superior air freight advantages. International passenger hubs at Cleveland, Columbus and Cincinnati place air travelers within an hour of two-thirds of the U.S. population. |

At several locations in the state the transportation modes are integrated into sophisticated intermodal logistics centers.

This infrastructure is one reason Ohio captures many of the plum distribution facilities each year. And it plays no small role in Ohio's standing as the nation's No. 1 recipient of new plants and expansions for the last three years running.

Big Players, Small Entrepreneurs

Ohio headquarters five of the nine Fortune 500 rubber and plastic companies -- Rubbermaid, Cooper Tire & Rubber, Lancaster Colony and Worthington Industries, plus Goodyear Tire & Rubber, the largest employer, with a work force of 6,800. Big machinery companies headquartered in Ohio include Cincinnati Milacron, HPM Corp. and Van Dorn Demag.

Headquartered in Akron is Advanced Elastomer Systems, the world's largest manufacturer of engineered thermoplastic rubber materials, doing business in 42 countries. The company, formed by the 1991 merger of Monsanto Co. and Exxon Corp.'s thermoplastic elastomers business, makes a wide range of products, from auto belts and hoses to the grips of kitchen utensils, from glazing used in skyscrapers to plunger tips in medical syringes.

| The company moved its worldwide headquarters from St. Louis to a former B.F. Goodrich building in downtown Akron in 1995. The company also has a design and technical center in Akron and a manufacturing facility in Wadsworth.

The company say it "has found Northern Ohio to be the ideal headquarters site close to key customers and markets."

Outside of headquarters, Ohio houses substantial manufacturing operations of such other firms as Carlisle Geauga Co. (1,680 employees), Continental AG (1,145), Cooper Tire & Rubber (2,850) and DuPont (1,131). Altogether, there are 41 companies employing more than 500 workers each in Ohio's rubber and plastics industry. |

| Plastics Processing Machinery in Ohio |

|

| Source: Complied from Plastics Technology Census Available Through D&S Resources, Inc./Plaspe. |

|

Capital expenditures in the rubber, resins and plastic products industries are over $400 million a year. From 1993 through 1995 Ohio's rubber and plastics industries invested in 231 projects, representing a total investment of $1.1 billion and creating over 8,700 jobs. Largest projects during the time frame were Chevron Chemical ($66.5 million), Ford Motor Co. ($65 million), BASF ($55 million) and Dow Chemical and Plastipak Packaging ($50 million each).

|

| ProTec's plant in Leipsic holds the world's record for production of galvanized steel. |

|

Among the largest new facilities in the state are Rubbermaid's new 104,000-sq. ft. plant in Wooster, built in 1991. Dow built a $49 million plant in Licking County for plastic film. DuPont selected Circleville for a $20 million facility, also for plastic film. Kamco Industries chose West Unity in Williams County for its $21 million plastic products plant.

|

But to suggest that these are typical of Ohio's plastics industry would be misleading. In fact, there are scores of new plastic products facilities coming on line in Ohio each year, and most of them are small businesses.

And it is in these small, but solid, companies that Ohio tells its most interesting stories. These are not the tales of molding machines -- though the way they squeeze, pound and blow pellets at gale force is impressive. Nor is it about products -- though many of them are intriguing. Ohio's best stories are about the people who have hooked their fortunes to a polymer star:

Like Ralph F. Litcraft, president of Proto Mold Products in Piqua. He saw his first molding machine 43 years ago. Awestruck, he watched the machine until the owner of the plant told him he had to leave -- 15-year-olds weren't allowed to touch the machinery. He came back the next year, got a job and began his lifelong fascination with plastics. Litcraft molds products for Evenflo and others. And what a task-master! He'll show you a "reject" with a blemish you can barely see, and say, "Not good enough. What we produce here has to be perfect!"

Like Ralph F. Litcraft, president of Proto Mold Products in Piqua. He saw his first molding machine 43 years ago. Awestruck, he watched the machine until the owner of the plant told him he had to leave -- 15-year-olds weren't allowed to touch the machinery. He came back the next year, got a job and began his lifelong fascination with plastics. Litcraft molds products for Evenflo and others. And what a task-master! He'll show you a "reject" with a blemish you can barely see, and say, "Not good enough. What we produce here has to be perfect!"

Like John Knight, president of FabriForm in Guernsey County. He points with pride to the Fabri-Form visor that Neil Armstrong looked through when the astronaut first stepped onto the moon. That was Fabriform up in space.

Like John Knight, president of FabriForm in Guernsey County. He points with pride to the Fabri-Form visor that Neil Armstrong looked through when the astronaut first stepped onto the moon. That was Fabriform up in space.

Like Andy Culbertson, whose AeroFrame Corp. in Adams County produces parts for GE's jet engine testing facility. The man is on the job at 2 a.m., making sure GE doesn't lose a penny because of downtime.

Like Andy Culbertson, whose AeroFrame Corp. in Adams County produces parts for GE's jet engine testing facility. The man is on the job at 2 a.m., making sure GE doesn't lose a penny because of downtime.

Like Frank Kelley, dean of the University of Akron's Institute of Polymer Science. We have never met an academic who was more tuned in to the needs of industry and more targeted in a university's role in the business community.

Like Frank Kelley, dean of the University of Akron's Institute of Polymer Science. We have never met an academic who was more tuned in to the needs of industry and more targeted in a university's role in the business community.

And everywhere, assemblers, mold-makers, machine operators, packers and materials engineers who would smile shyly when we asked if we could take their pictures. As if they weren't important!

(You will learn more about these and many other innovative companies in the county and community vignettes that follow.)

Strong Supplier Base

Because of its strong industrial history, Ohio has amassed the inputs, services and expertise that engineered materials manufacturers need. This is not true of states that have industrialized in more recent times. Skills like mold-making or color compounding are all but absent in some upstart manufacturing states.

Inputs for Ohio-made plastic products are either available from resin producers in the state or easily accessible by rail and truck.

Ohio-based resin suppliers include Quantum Chemical Corp., Geon Co. and Ashland Chemical Co. Ohio ranks fifth in the nation in resins production, behind such petrochemical powerhouses as Texas and Louisiana, plus Illinois and West Virginia. One of Ohio's main assets for the resins industry is, of course, the Ohio River. Barges laden with feedstocks ply the waterway to the massive resins plants that line both sides of the river in Ohio and West Virginia.

| Three dozen other plants, owned by A. Schulman, M.A. Hanna Co., Ferro Corp. and many smaller companies, specialize in compounding, or blending in colorants, reinforcements and other additives to make new materials.

Other Ohio compounders include Multibase of Copley, Diamond Polymers of Akron and the Miles compounding plant in Newark.

There are some 450 industry-related companies comprising custom compounders, mold makers, resin producers, processing machinery builders, colorant and chemical suppliers, distributors and others. |

|

| Patrick Plastics makes bottles for sanitation and agriculture products in Putnam County. |

|

Tomorrow's Workforce

Ohio has an innate advantage in its work force. In interviews with scores of companies for this report, work ethic was invariably identified as a top-ranking asset.

For industries that require knowledgeable scientists and technicians, Ohio measures up. It is said that Ohio has the greatest concentration of rubber and plastics academics in the world. For example, the University of Akron, named recently as the second-ranking polymer science university in the nation by U.S. News & World Report, sends its graduates to polymer producers around the globe. (For more on what this expertise means to the plastics industry, see page 22.)

The university is no ivory tower. Professors interact with industry, readily sharing the enormous pool of knowledge with Ohio's polymer firms and partnering in the commercialization of products. Equally important is the fact that the University of Akron invested in the state's premier training center for practical education of the work force.

Dr. Frank Kelley, dean of the University of Akron's Institute of Polymer Science, tells how the center came about:

"In the late 70s and early 80s, Ohio was being characterized as the 'Rust Belt.' Everyone was wringing their hands about what we were to become.

"We put together a master plan in which economic development was a key element. We recognized that our programs had to be not just academic, but also close to the end users. The university invested $1 million in a training center, with classrooms, computer lab and a large area for processing equipment to give trainees hands-on experience. Students can pour pellets, turn knobs and look at what comes out of the machine. We've put over 700 people through the training center in the last two-and-a-half years."

A dozen four-year education institutions offer degree programs in fields related to polymer science. One of the best in producing graduates ready to roll up their sleeves and get to work is Shawnee State College in Portsmouth. One hundred percent of its graduates find jobs in the plastics industry immediately after graduating.

| But the majority of Ohio's plastics workers are semi-skilled, which in this context means they must be computer-literate and capable of commanding a CNC machine. To meet those needs, Ohio has abundant vocational and tech school resources. Some 17 vocational schools and 13 community colleges scattered across the state train the workforce in such subjects as industrial technology, mechanical, process, mold and tool engineering.

For mold-making, the industry needs highly skilled technicians. Programs to produce these specialists include the National Center for Tooling and Precision Components in Toledo, The Akron Machining Institute in Norton, the Manufacturing Learning Center at Cleveland Advanced Manufacturing Program, Sinclair Community College in Dayton and Great Oaks Joint Vocational School in Cincinnati. |

| Ohio's Rank in U.S. Plastics Industry Jobs, by SIC |

|

| Rank |

Jobs |

Percent |

SIC Classification |

| 1st |

63,021 |

9.1% |

SIC 308 |

Miscellaneous plastics products 1 |

| 1st |

46,959 |

10.7% |

SIC 3089 |

Plastics products, n.e.c 2 |

| 1st |

3,579 |

13.8% |

SIC 3082 |

Production of plastics profiles |

| 1st |

2,007 |

8.9% |

SIC 3087 |

Custom resin-compound production |

| 2nd |

1,831 |

8.8% |

SIC 3085 |

Plastic bottle manufacturing |

| 4th |

983 |

6.2% |

SIC 3084 |

Plastic pipe manufacturing |

| 5th |

3,253 |

5.6% |

SIC 3081 |

Plastic film and sheet production |

| Source: 1996 U.S. Bureau of Labor Statistics & Ohio Department of Development reports. |

| 1 All plastic parts fabrication |

| 2 Plastic parts fabrication, not elsewhere classified |

|

|